The Greece Golden Visa, also known as the Greece Investment Visa, offers a pathway to EU residency for non-EU/EEA nationals through investment. The program provides access to a strong real estate market, high returns, visa-free travel within the Schengen Area, and favorable tax benefits.

This guide explains everything you need to know about the Greek Golden Visa, including who can apply, the documents needed, how to apply, benefits, and more.

This is more of what we will cover:

- What is the Greece Golden Visa program?

- Greece Golden Visa benefits

- Greek Golden Visa eligibility criteria

- Investment options for the Greek Golden Visa program

- Documents required for the Greek Golden Visa program

- How To Get The Golden Visa Greece: Step-By-Step Application Guide

- Golden Visa Greece: Application processing timeline

What is the Greece Golden Visa program?

To qualify, applicants must have a clean criminal record and invest at least €250,000 in Greek real estate. Recent changes have increased the investment amount to €800,000 for properties in certain regions like northern and central provinces, South Athens Attica, Thessaloniki, Mykonos, and Santorini. In other areas, a €400,000 investment is required.

Golden Visa holders can apply for Greek citizenship after seven years of continuous residence, with at least 183 days spent in Greece each year. Fluency in Greek is also required for naturalization. The Greece Golden Visa is ideal for those interested in European citizenship while enjoying the benefits of permanent residency.

Golden Visa Greece September 2024 update

In September 2024, Greek Prime Minister Kyriakos Mitsotakis announced plans to introduce a new investment option for the Greece Golden Visa program. Foreign investors can get a five-year residence permit by investing a minimum of €250,000 in Greek startups. Additional details have not yet been announced, such as an implementation date or whether the investment will be limited to certain businesses or locations.

Greece Golden Visa Benefits

- Inclusion of immediate family members: Residency extends to the entire family, which includes children under the age of 21 and dependent parents of both the applicant and their spouse.

- Access to excellent healthcare: Permanent residence visa holders can access Greece’s highly-rated healthcare system (if they meet the eligibility criteria to apply for it) and benefit from free and equitable services, as well as incredible medical insurance spread across the public and private sectors.

- Access to an excellent education system: Children of applicants can benefit from Greece’s well-respected education system, which is available to all residents and citizens.

- Visa-free travel in Europe’s Schengen Area: As part of the European Union and a member state of the Schengen Area, Greek residence permit holders can travel without hassle within the EU and the Schengen Area.

- Tax deductions and benefits through the non-dom regime for investors: The Greece Golden Visa tax implications can be reduced through the Greece Non-Dom tax regime. It is a unique scheme allowing foreign nationals who transfer their tax residence to Greece to avoid paying tax on foreign income by paying a lump-sum annual tax.

- High returns on investment: Greece Golden Visa holders have the option to rent out their purchased investment property or hold shares in a company registered in Greece and receive dividend income. This means they can continue to have positive cash flow while maintaining their investments.

- ETIAS and EES Exemption: You’re exempt from the European Travel Information and Authorization System (ETIAS) and Entry/Exit System (EES).

Greek Golden Visa Eligibility Criteria

To qualify for the Greek Golden Visa program, you must fulfill the following Greece Golden Visa requirements:

- Be over the age of 18 at the time of application

- Be non-EU citizens

- Have no criminal record

- Make a significant investment as stipulated by the Greek government and provide proof of the respective financial investment.

- Have Greek private health insurance, which shall cover all health and safety risks

Greek Golden Visa qualifying dependents

- Spouse or partner: The applicant’s spouse or registered partner, recognized either in Greece or by the Greek Consular Authority, is eligible to join the application.

- Children under 21: Unmarried children of the applicant or their spouse/partner who are under 21 years of age are included.

- Spouse/partner’s children under 21: Unmarried children under 21 of the applicant’s spouse or partner are also eligible, provided the applicant has legal custody.

- Parents of the applicant and spouse/partner: The parents of the applicant and their spouse or partner, as direct first-degree relatives, can also be included.

Notes on dependents

Please take note of the following:

- Unmarried Partners: They are not considered family members and cannot be included in the Golden Visa application.

- Dependent Children: Children qualify as dependents until they turn 21. After that, they must apply for their own residence permit.

- Children Aged 21-24: Unmarried children between 21 and 24 can get a residence permit, valid until 24, with an option to renew.

- Dependent Parents: Parents can be included with no age limit but cannot work in Greece.

It’s important to note that you no longer need to visit Greece to start the Golden Visa application process.

Investment Options for the Greek Golden Visa Program

Greece offers various investment options for its Golden Visa program. These include real estate investments in specific regions, as well as alternative options such as government bonds, venture capital fund shares, and shares in real estate investment companies.

Real estate investment options

As of August 31st 2024, there have been Greek Golden Visa new rules. The new tier system has brought forward increased minimum investment amounts as follows:

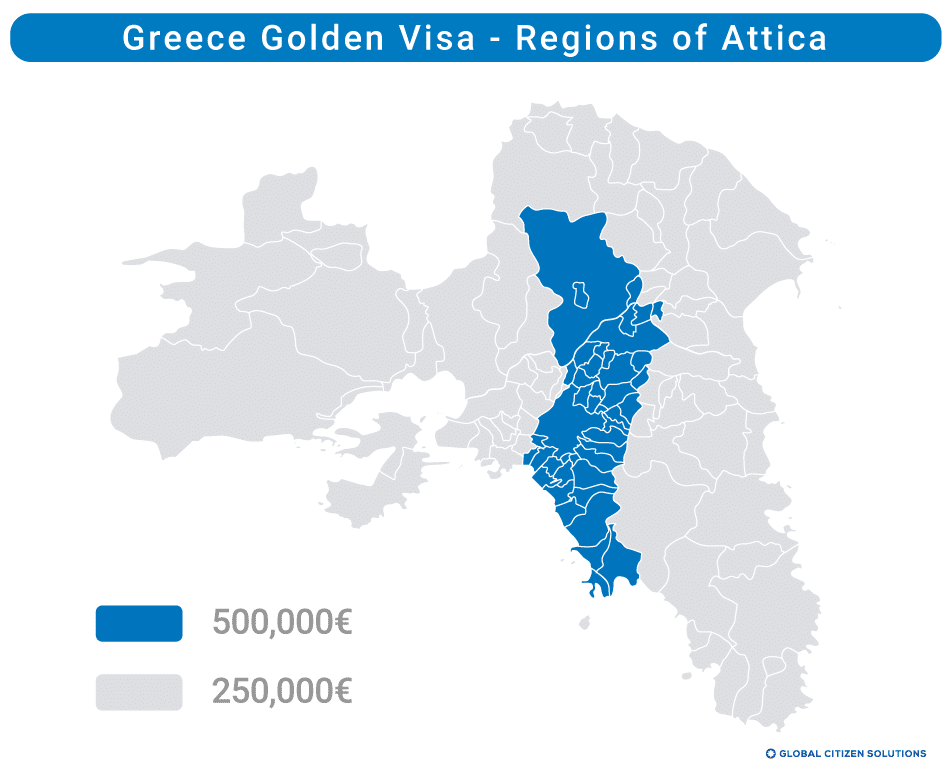

- Tier 1 Investment: To qualify, applicants must invest €800,000 in high-demand areas such as Athens, Thessaloniki, Mykonos, Santorini, or other islands with over 3,100 residents. The property purchased must be at least 120 square meters in size.

- Tier 2 Investment: For a €400,000 investment, this option is available in regions of Greece that are less populated, encouraging development in emerging areas. As with Tier 1, the property must be no smaller than 120 square meters.

- Tier 3 Investment: Applicants investing €250,000 can choose properties that have been converted from commercial to residential use. The size and location of the property don’t matter, but the conversion must be finalized before applying for the Golden Visa.

- Tier 4 Investment: This €250,000 option is directed toward properties of historical or cultural value. The investor must have fully restored or reconstructed the property to meet the Golden Visa requirements.

Below is a map of the eligible real estate investments in the Greek region of Attica.

Conditions for purchasing property in Greece

Certain conditions that must be met for an investor to proceed with the purchase of a property, namely:

- If the property is bought through a legal entity, the investor must fully own it or hold 100% of the company’s shares.

- Greece Golden Visa properties cannot be used for short-term rentals (such as holiday accommodations) or as company headquarters.

- Tier three properties cannot be used as a company’s official headquarters.

Any violations can result in a €50,000 fine and a revocation of the residence permit.

Leasing property in Greece

To qualify for the Greek Golden Visa through property leasing, you must sign a 10-year lease or timeshare agreement for hotel accommodations or furnished residences in designated resorts. The lease must total €250,000, paid in one lump sum for the 10-year period. For high-demand areas like Athens, Thessaloniki, Mykonos, and Santorini, the lease amount increases to €500,000, paid in full before applying for the permanent residence permit. Investors can maintain residency by renewing their Golden Visa every five years if they keep their investment.

Capital contribution

- Invest at least €500,000 in a Greek company (excluding portfolio and real estate firms).

- Invest €500,000 in a real estate investment company focused on Greece.

- Invest €500,000 in a closed-end investment company or mutual fund that focuses solely on Greek companies.

Shares, Corporate Bonds, or Government Bonds

- Invest €800,000 in shares or corporate bonds listed on regulated markets in Greece.

- Invest €500,000 in Greek government bonds with a maturity of at least three years.

- Invest €350,000 in units from a mutual fund or alternative investment fund focused on Greek shares, corporate bonds, or government bonds.

Capital transfer

- A fixed-term deposit of at least €500,000, held in a Greek bank account or other national credit institution, maintained for a minimum of one year with an automatic renewal arrangement in place

Documents Required for the Greek Golden Visa Program

The current required documents for the Greece Golden Visa application are:

- Application form: Submit two copies of the Greece Golden Visa application.

- Passport: Provide a certified copy of all passport pages; it must be valid with at least two blank pages and issued within the last ten years.

- Passport photos: Include four recent passport-sized photos that meet Schengen Visa photo requirements.

- Proof of investment: Submit a notarized real estate purchase agreement or relevant investment documents.

- Proof of funds: Provide documentation showing the source of investment funds, such as bank statements.

- Health insurance: Submit a certified health insurance policy covering medical expenses in Greece for you and your family.

- Criminal record: Provide a certificate of good conduct issued within the last six months.

- Medical certificate: Include a certificate confirming you are free of contagious diseases.

- Proof of payment: Provide evidence of application fee payment.

- Occupational information: Depending on your investment, submit a CV or proof of occupation.

- Family documentation: If applicable, include certified marriage and birth certificates for dependent family members.

How To Get The Golden Visa Greece: Step-By-Step Application Guide

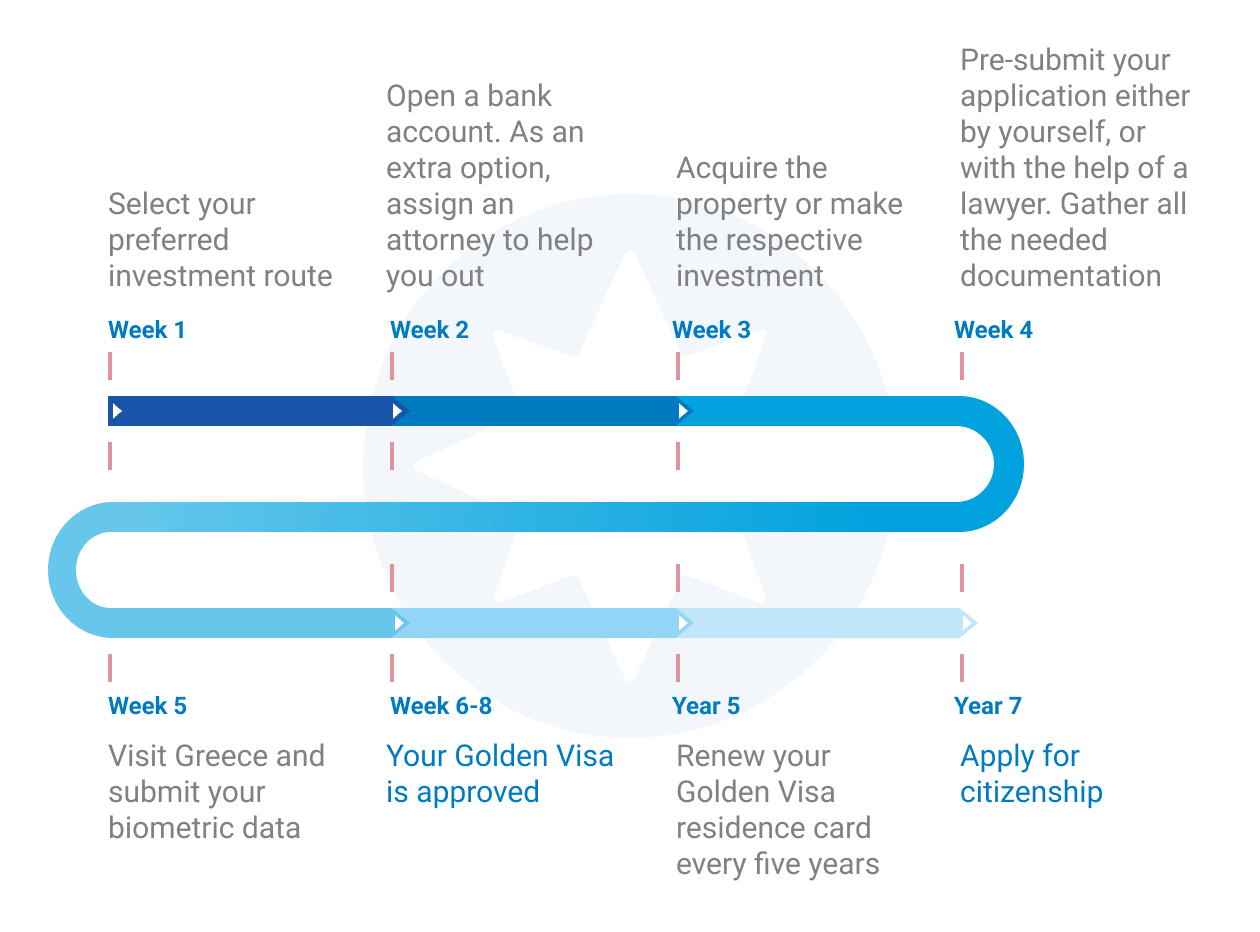

The steps to qualifying for the Greece Golden Visa are few and simple. All applicants must make a substantial investment in the country, whether in real estate, Greek government bonds, or other capital funds. Regardless of their choice, the process will look the same for everyone; here are the steps:

1. Choose Your Investment: Decide on the type of investment option you wish to pursue.

2. Get a Greek Non-Resident Tax Number (AFM): Obtain this tax number, required for property purchases and financial transactions, from a local tax office or through a Greek lawyer.

3. Open a Greek Bank Account: Set up a Greek bank account to handle investment transactions, including transferring funds.

4. Make Your Investment: Finalize your investment, whether buying property or another qualifying investment. Ensure you have a signed purchase agreement, and the property is registered in your name.

5. Gather Required Documents: Collect all necessary documents for your application.

6. Submit Biometric Data: Travel to Greece to submit your fingerprints and photographs at an immigration office or consulate.

7. Submit Your Application: You can submit your application either in person or through a legal representative.

8. Wait for Processing: The application typically takes 1 to 3 months to process, depending on the completeness of your application and investment type.

9. Receive Approval: You’ll get a notification once your application is approved.

10 Submit Biometric Data (Again): After approval, the main applicant and family members must travel to Greece again to provide biometric data at an immigration office or consulate.

11. Collect Your Residence Permit: After submitting biometric data, you’ll be granted a 1-year multiple-entry visa and must visit Greece to collect your 5-year renewable residence permit.

12. Renew After 5 Years: After 5 years, you can renew your residency.

13. Apply for Citizenship After 7 Years: After 7 years of living in Greece, you can apply for citizenship.

Golden Visa Greece: Application Processing Timeline

Greece Golden Visa Program Fees

There are extra fees to consider on top of your investment sum, including legal fees, translation fees, tax fees, and other administrative costs. If you choose the real estate property investment route, you can expect to pay around 11 to 12 percent of the investment property value.

Some estimated costs to consider for real estate property investments:

- Application fee main applicant – €2,000

- Application fee each family member – €150 (children under 18 exempt)

- Processing fee for the residence permit per person – €16

- Additional costs may include legal fees and notary fees, typically amounting to 8-10% of the total investment.

Fees related to the real estate purchase:

- Property Transfer Tax: Approximately 3.09% of the property’s value

- Notary Public Fees: 1% to 1.5% of the property’s value

- Land Registry Fee: Approximately 0.6% to 0.8% of the property’s value

Note that these are not fixed prices; they are estimated fees.

Greece Golden Visa Renewal Process

The documents needed to renew Greek Golden Visa residence permits are primarily:

- An application form

- Four recent colored passport photos

- A certified copy of all pages of a valid passport

- A certified copy of your previous permanent residence permit

- Certified proof of active Greek health insurance

Relevant authorities may request additional documents for Greece residency by investment permit holders.

The conditions you will need to meet in order to renew your Greek Golden Visa residence permit are:

- You remain the full owner of the purchased real estate property, or you maintain your investment

- You’ve ensured all relevant leases and contracts are still valid and abide by government requirements

How to Get Greek Citizenship Through Golden Visa

Greece doesn’t offer citizenship by investment, but you can apply for citizenship by naturalization after spending seven years in Greece for at least 183 days each year.

Investors also have to meet additional requirements, such as demonstrating integration into Greek society and passing a language test. According to the Common European Framework of Reference for Languages (CEFR), applicants have to pass a Greek language exam at a minimum level of B1. This test is known as the Greek citizenship test.

Greece Golden Visa Statistics

The Golden Visa in Greece is one of Europe’s most competitive Golden Visas, seeing incremental growth over the years due to its many alluring benefits. In 2024, Greek authorities received 9,289 applications for the Golden Visa Program, marking a 10% increase compared to the previous year.

Residence permits to investors/real estate owners per year

Year | Investment |

2014 | 359 |

2015 | 412 |

2016 | 483 |

2017 | 955 |

2018 | 1,893 |

2019 | 3,535 |

2020 | 938 |

2021 | 1,035 |

2022 | 6,159 |

2023 | 4,244 |

2024 | 9100 |

Total Investment | €5.54 billion |

Source: Ministry of Migration and Asylum / General Secretariat for Immigrations Policy (31.12.2021)

Nationalities:

- China: 6,405 applicants

- Turkey: 618 applicants

- Russia: 596 applicants

- Lebanon: 304 applicants

- Egypt: 250 applicants

- Iran: 194 applicants

- Iraq: 135 applicants

- Ukraine: 112 applicants

- USA: 103 applicants

- Jordan: 86 applicant

Greek Taxes and Deductions for Golden Visa Holders

Greece offers a non-domicile tax regime that allows foreign nationals who relocate their tax residence to Greece to exempt foreign income from taxation by paying a fixed annual tax of €100,000. This is available to individuals who were not Greek tax residents for the previous seven years and who invested at least €500,000 in Greek assets. The tax exemption can extend to family members for an additional €20,000 per person.

Greece also has a double taxation treaty with 57 countries to prevent double taxation. Additionally, retirees, digital nomads, and expats may benefit from tax exemptions or reduced rates. However, income earned in Greece is subject to taxes, including property tax and rental income tax for real estate owners.

Countries that have a double taxation treaty with Greece:

Albania | Armenia | Austria | Azerbaijan | Belgium | Bosnia and Herzegovina | Bulgaria |

Canada | China | Croatia | Cyprus | Czech Republic | Denmark | Egypt |

Estonia | Finland | France | Georgia | Germany | Hungary | Iceland |

India | Ireland | Israel | Italy | South Korea | Kuwait | Latvia |

Lithuania | Luxembourg | Morocco | Mexico | Malta | Moldova | Netherlands |

Norway | Poland | Portugal | Qatar | Romania | Russia | Saudi Arabia |

San Marino | Serbia | Slovakia | Slovenia | South Africa | Sweden | Spain |

Switzerland | Turkey | Tunisia | Ukraine | United Arab Emirates | United Kingdom | United States |

Uzbekistan | ||||||

Investors can apply for the Greece Golden Passport after continuous residence and becoming tax residents. They must pay income tax on foreign earnings, with a flat 7% rate for the first ten years. The non-dom tax status allows for a fixed lump-sum tax instead.

In addition to property taxes, Greece imposes gift and inheritance taxes based on kinship:

- Category A: Spouses, children, parents

- Category B: Siblings, grandparents

- Category C: Other relatives

How Can Global Citizen Solutions Help You?

Global Citizen Solutions is a boutique migration consultancy firm with years of experience delivering bespoke residence and citizenship by investment solutions for international families. With offices worldwide and an experienced, hands-on team, we have helped hundreds of clients worldwide acquire citizenship, residence visas, or homes while diversifying their portfolios with robust investments.

We guide you from start to finish, taking you beyond your citizenship or residency by investment application.

Frequently Asked Questions about the Greece Golden Visa

What is the Golden Visa scheme in Greece?

The Golden Visa in Greece is a European residency by investment scheme whereby non-EU/EEA citizens are granted legal residence in return for a qualifying investment in the nation. The investment usually comes in the form of real estate, shares of a Greek company, or an investment in public debt.

What are the benefits of applying to the investment program?

The Greece Golden Visa investment program offers numerous benefits, including permanent residency for investors and their families, access to Greece’s high-quality healthcare and education systems, and the ability to travel freely within the Schengen Area. Additionally, investors can qualify for citizenship after seven years of continuous residence.

Can I buy Greek citizenship?

No, you cannot directly purchase Greek citizenship. However, through the Greece Golden Visa program, investors can obtain residency by making a qualifying investment. After seven years of continuous residence, they may apply for citizenship through naturalization, meeting specific requirements.

Are there any restrictions in place for purchasing real estate in Greece?

There are no restrictions on foreign property ownership in Greece. Investors can qualify for the Golden Visa with real estate investments starting at €400,000. Higher investments of €800,000 apply to prime areas like Athens and Mykonos. Additionally, properties converted from commercial to residential use or those with cultural significance may qualify with a €250,000 investment.

How long does it take to get my Golden Visa?

The average processing time for a Greece Golden Visa is three to five months. Once your application has been approved, it usually takes about two months to receive your residence permit but you may wait longer if there is a backlog.

Do I have to go to Greece for my application?

You don’t need to visit Greece before or during the Greek Golden Visa application process. However, you will need to go to Greece to submit your biometric data once your visa has been approved in order to receive your residence card permit.

What family members can I include when applying for a Golden Visa?

Third-country nationals seeking family eligibility for the Greece Golden Visa applications can include their spouse, unmarried dependent children under age 21, unmarried dependent children of the spouse under age 21, and the primary applicant/spouse’s parents and grandparents. Essentially, the visa program extends to the entire family.

Can I work in Greece with a Golden Visa?

The Greece Golden Visa does not include automatic work rights. Golden Visa holders must obtain a separate work permit to be eligible for employment in Greece.

Are there other Golden Visa programs?

Other Golden Visa programs include the Portugal Golden Visa, Spain Golden Visa, Malta Residency by Investment, and Cyprus Golden Visa. These programs grant residency or citizenship in exchange for investments in real estate, business, or government bonds, each with its own benefits and requirements.

Can I retire in Greece after Brexit?

Following Brexit, British expats now follow non-EU/EEA procedures to apply for Golden Visas. However, British passport holders can stay in Greece for up to three months without requiring a visa. Before their travel permit expires, they must apply for legal residency.

Is it necessary to hire a lawyer to collect all documents?

It is recommended to hire a lawyer to ensure that you have all the necessary documents per Greek immigration law and the requirements set by the relative Greek authorities.

Can a non-EU investor travel to other countries within the EU with the Greek permit granted to real estate owners?

The permanent residence permit granted to non-EU citizens who qualified for the Greece Golden Visa program through real estate investment provides visa-free access to European countries in the EU and within Europe’s Schengen zone.

Can Americans apply for a Golden Visa in Greece?

Citizens of the United States are among those eligible to apply for Golden Visas in Greece. Many Americans living in Greece have already benefitted from this immigration investment scheme.

Are there any restrictions on selling the property purchased for a Golden Visa?

Buyers who invest in Greek Golden Visa real estate can sell their property anytime, but it must be held for the duration of the visa to maintain residency. If the property is sold, the visa may be retained if a new property of equal value is purchased.

Can you get a mortgage for a Golden Visa?

You can get a mortgage to buy a property through the Greece immigration investment program, provided the mortgage does not cover the required minimum investment amount. Golden Visa applicants must finance the qualifying investment entirely from overseas funds.

Are unmarried partners entitled to Golden Visas in Greece?

Greece Golden Visas for family members does not extend to unmarried partners or cohabiting couples, except if they enter into a cohabitation agreement in Greece or their origin country, depending on their nationality. This option needs to be analyzed case by case.

Is it possible to rent the real estate property to third parties?

Third-country nationals who have obtained Greek Golden Visas by purchasing real estate are legally permitted to rent out their property to third parties while maintaining their visa status. However, short term stays are strictly prohibited and could lead to a fine of €50,000.

How much does the Greek Golden Visa cost?

The estimated fee for the Greek Golden Visa, is based on the investment option selected. The application fee for the main applicant is €2,000 and €150 for each family member.

Do I need to move my tax to Greece?

If you obtain a Greek Golden Visa, you are not required to change your tax residency to Greece as there is no minimum-stay requirement. This means that you are not obligated to pay taxes in Greece unless you reside in the country for more than 183 days per year.

Are there higher education options for Greece Golden Visa holders?

As a Golden Visa holder legally residing in Greece, if you or your child graduates from a Greek high school, you will have the same access to higher education as Greek nationals. This means you and your children will pay the same tuition fees as Greek citizens.

What are the new rules for the Greece Golden Visa?

As of September 2024, Greece’s Golden Visa program will raise the minimum investment requirement for residency permits through property investment from €250,000 to €800,000 in high in-demand areas. This adjustment is intended to tackle rising property prices and encourage more balanced development.

Patricia Casaburi

Patricia Casaburi